When stepping into the dynamic world of online trading, the platform you choose becomes your closest ally. It’s not just about the number of assets available or the range of features; what really matters is whether the interface is trustworthy. A reliable trading interface can make the difference between a positive trading experience and potential financial missteps. But what defines a trustworthy trading interface? Let’s explore the key features that separate the dependable from the dubious.

1. Transparent and Real-Time Data

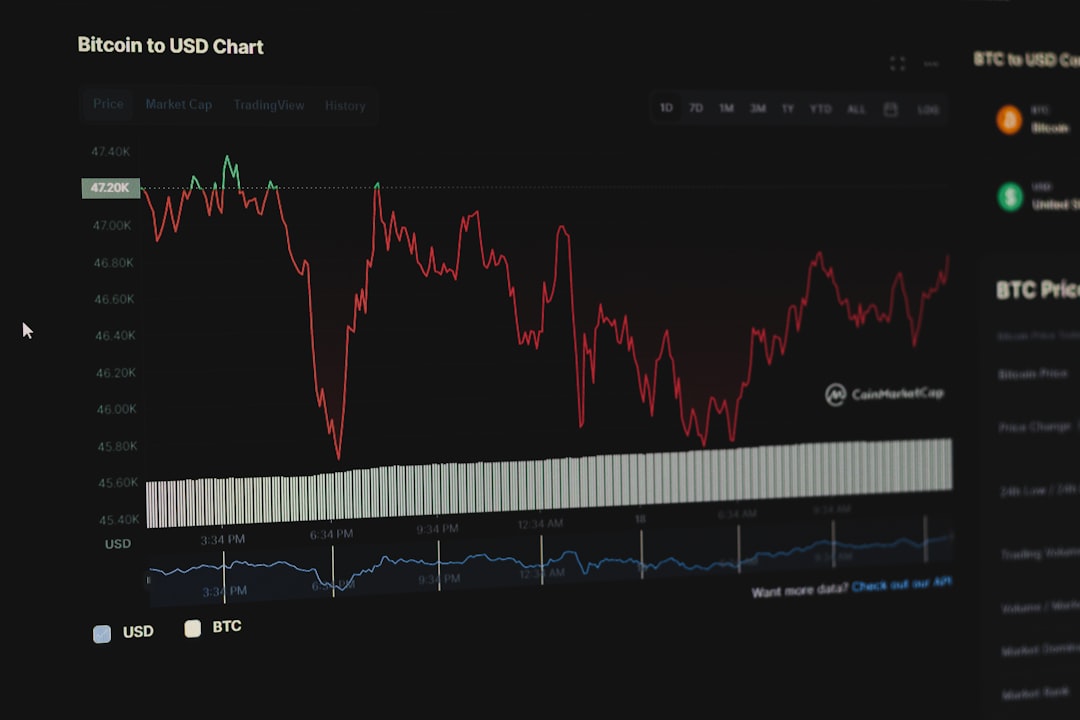

One of the first signs of a reliable trading interface is transparent and real-time data. Traders rely on accurate information to make split-second decisions. Prices, volume, and trends must be updated consistently without delay.

Look for platforms that display market depth, bid/ask spreads, and historical charts with real-time updates. This level of transparency fosters confidence and helps traders avoid surprises.

2. Intuitive User Interface

No matter how powerful a platform is under the hood, it loses its edge if it isn’t easy to navigate. A trustworthy trading interface prioritizes usability. It should feel intuitive on both desktop and mobile, offering a seamless experience across devices.

Key aspects of a user-friendly interface include:

- Simple navigation menus

- Clear font and color schemes that reduce eyestrain

- Customizable dashboards

- Efficient order placement workflows

These features ensure that both beginners and seasoned traders can operate efficiently under pressure.

3. Robust Security Features

Security is non-negotiable when it comes to trading interfaces. Because financial data and transactions are involved, platforms must employ advanced security protocols to protect users.

Look for the following security features:

- Two-factor authentication (2FA)

- Encryption of personal and financial data

- IP detection and login alerts

- Cold storage for digital assets (in case of crypto platforms)

When a platform invests in protecting your assets, it shows a deeper commitment to user trust.

4. Reliable Customer Support

A trustworthy platform doesn’t disappear when you face an issue. It provides clear and accessible customer support channels, offering help when you need it most. From live chat to email and even phone support, responsive assistance is an essential component of trust.

Moreover, check whether the platform offers educational resources, FAQs, and user communities. These supplemental tools enhance your understanding while fostering transparency.

5. Regulatory Compliance

Before jumping in, ensure that the trading interface operates under the oversight of recognized financial regulatory bodies. Whether it’s the U.S. Securities and Exchange Commission (SEC), the Financial Conduct Authority (FCA) in the UK, or any regional watchdog, regulation is key.

Why is this important? Regulatory oversight ensures that the platform follows legal frameworks designed to protect consumer interests. Platforms that display licenses proudly portray an added layer of legitimacy.

6. Transparent Fee Structures

Hidden fees can erode your profits faster than a bad trade. A reliable trading interface presents its pricing structure clearly before any transactions are made. Whether it’s commissions, spreads, or withdrawal charges, all fees should be easy to locate and understand.

Trustworthy platforms may even offer a fee calculator or break down typical costs per transaction type. This level of detail reflects sincerity and a user-first mindset.

7. Performance and Uptime

The most secure and robust platform won’t be worth much if it fails when markets move fast. Consistent system uptime and fast transaction execution are hallmarks of a high-quality interface. Regular maintenance notices, system health dashboards, and an infrastructure built to handle high-volume trading are essential.

8. Analytical Tools and Advanced Features

Advanced tools don’t just elevate the experience; they empower the trader. Platforms equipped with technical indicators, customizable charting systems, backtesting capabilities, and even AI-driven insights demonstrate a commitment to providing traders with an edge.

These features reveal how much the platform values its users’ long-term success.

Conclusion

In a market where milliseconds matter, and financial stakes are high, a trustworthy trading interface is more than just software—it’s your gateway to informed decision-making and peace of mind. From user-centered design and advanced security to transparent practices and robust features, the best platforms are built on trust as much as technology. Before choosing where to trade, take the time to evaluate platforms against these critical features to safeguard your assets and your confidence.